AVIOR INSIGHTS – How Layoffs and Slower Consumer Spending Affect the Broader Economy

Layoff announcements are ramping up as companies adjust to slowing sales and profitability. So far, major job cuts have been concentrated in technology and consumer-related industries due to overhiring during the pandemic recovery when demand was unusually strong. Whether this spills into the broader economy is the subject of debate among investors and economists. With markets already expecting a mild recession in 2023, how should long-term investors maintain perspective on this topic over the next year?

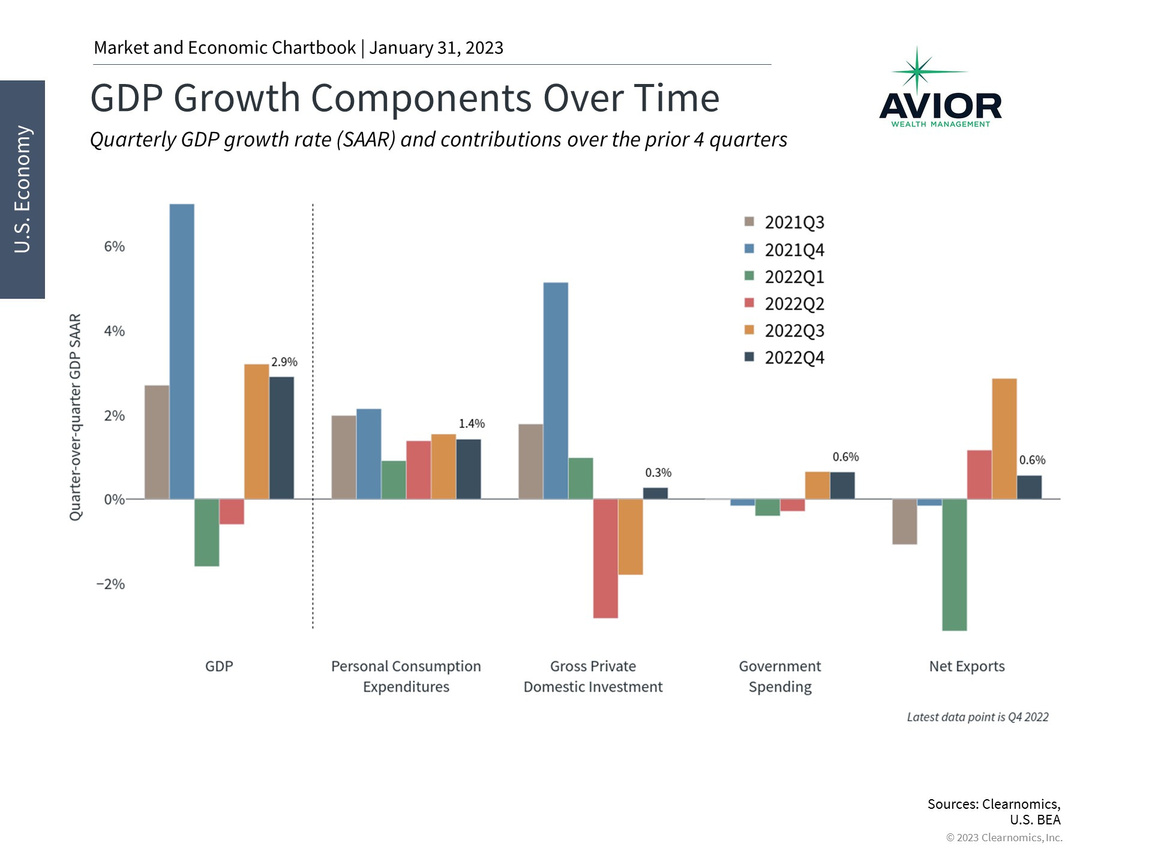

There is no doubt that the economy has slowed from the rapid post-pandemic pace that fueled overexpansion by companies and, arguably, overconfidence. Recent GDP data show that the economy grew 2.1% in 2022 compared to 5.9% the year before. From a macroeconomic perspective, this is the result of the usual culprits that have dampened the mood of consumers and businesses: inflation and Fed rate hikes. This has hit the category of residential fixed investment especially hard as the housing market adjusts to higher interest rates. Similarly, consumer spending slowed at the end of last year with retail sales figures declining 1.1% in December and personal consumption expenditures, which are adjusted for inflation, falling 0.1% in November and 0.2% in December.

The economy has slowed over the past year

Consumer spending both impacts the job market and is impacted by it. Strong consumer spending drives top-line revenue growth for businesses and creates incentives to expand. Technology and consumer sectors in particular benefited from these trends over the past few years as households spent their pandemic savings and stimulus checks, while also taking on more debt. This fueled rapid hiring activity and led to record job openings and strong wage gains. In December, the average wage increase for hourly workers was about 5% from the year before – not better than inflation, but positive nonetheless.

The reversal of these trends as households reduce discretionary items, including on personal computers and home furnishings, is why these sectors are now experiencing layoffs, even though staffing levels are still generally higher than they were beforehand. Large tech companies including Alphabet, Meta, Microsoft, Amazon and Salesforce are laying off thousands, ranging from 2% to 10% of their workforce. In embattled areas such as crypto, job cuts have been much worse even among established players such as Coinbase which is laying off 20% of its staff. Outside of tech, companies such as Dow, 3M, Hasbro, Wayfair and many others have announced similar job cuts.

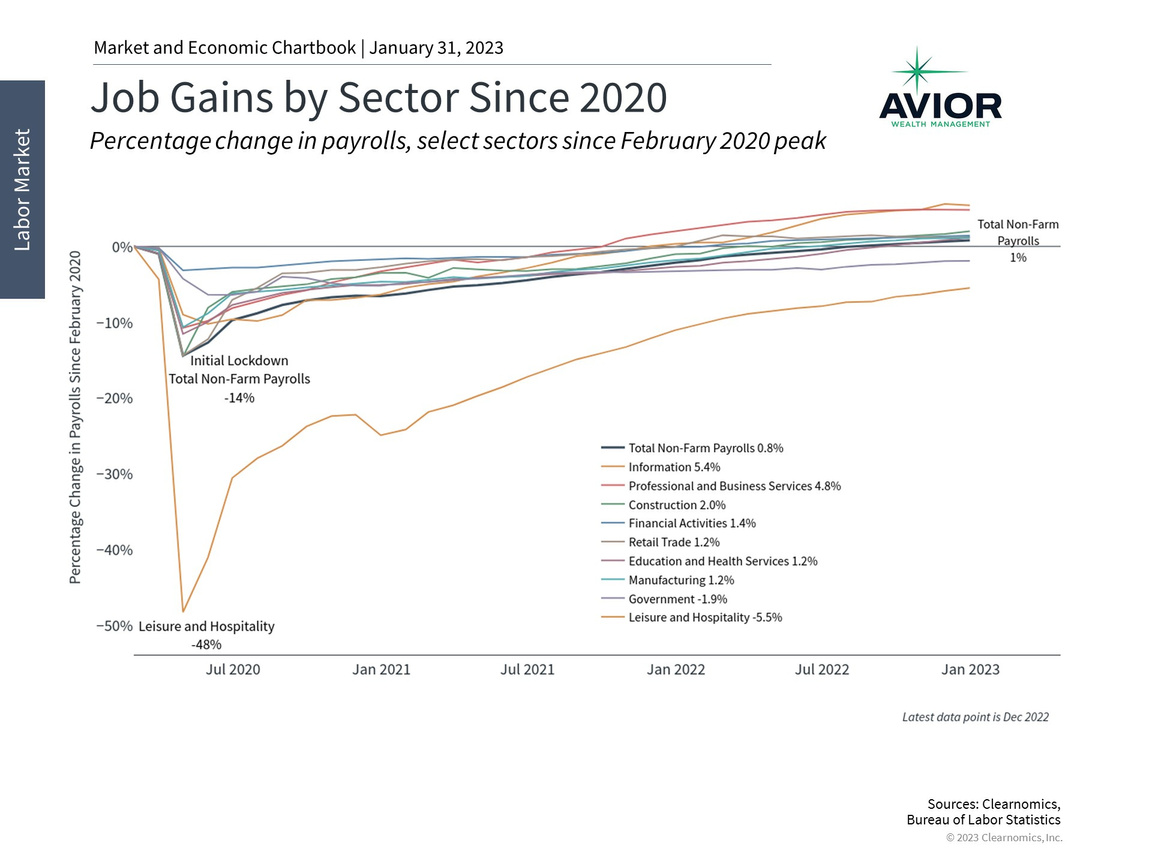

Job gains have slowed with sectors such as Information experiencing layoffs

While layoffs are never pleasant for individuals or companies, investors need to maintain a broad perspective to best understand how they might affect markets. Whether these layoffs have a domino effect on the rest of the economy depends on whether they are only the result of overhiring in specific industries, or due to broader economic trends such as slowing growth and the Fed’s battle against inflation. There are a few key facts to keep in mind.

First, these layoffs which number in the hundreds of thousands, while large in isolation, are a drop in the bucket compared to the overall economy which added 4.5 million net new jobs in 2022, 6.7 million in 2021, and averaged 2.3 million each year in the decade leading up to the 2020 recession. Similar to the early 2000s tech bubble, the economic impact has been isolated so far even if it’s had a large impact on specific sectors. In this sense, current layoffs represent a “white-collar recession.” Areas such as manufacturing and even leisure and hospitality have not yet been subject to similar job cuts.

Second, while it’s still too soon to say for certain, there are signs that the rest of the economy can remain healthy. Although GDP slowed in 2022, growth was robust in the second half of the year. Inflation has been easing over this same period, increasing the likelihood that the Fed pauses its rate hikes later this year. And while many expect flat GDP growth in 2023, few expect anything worse than a mild recession.

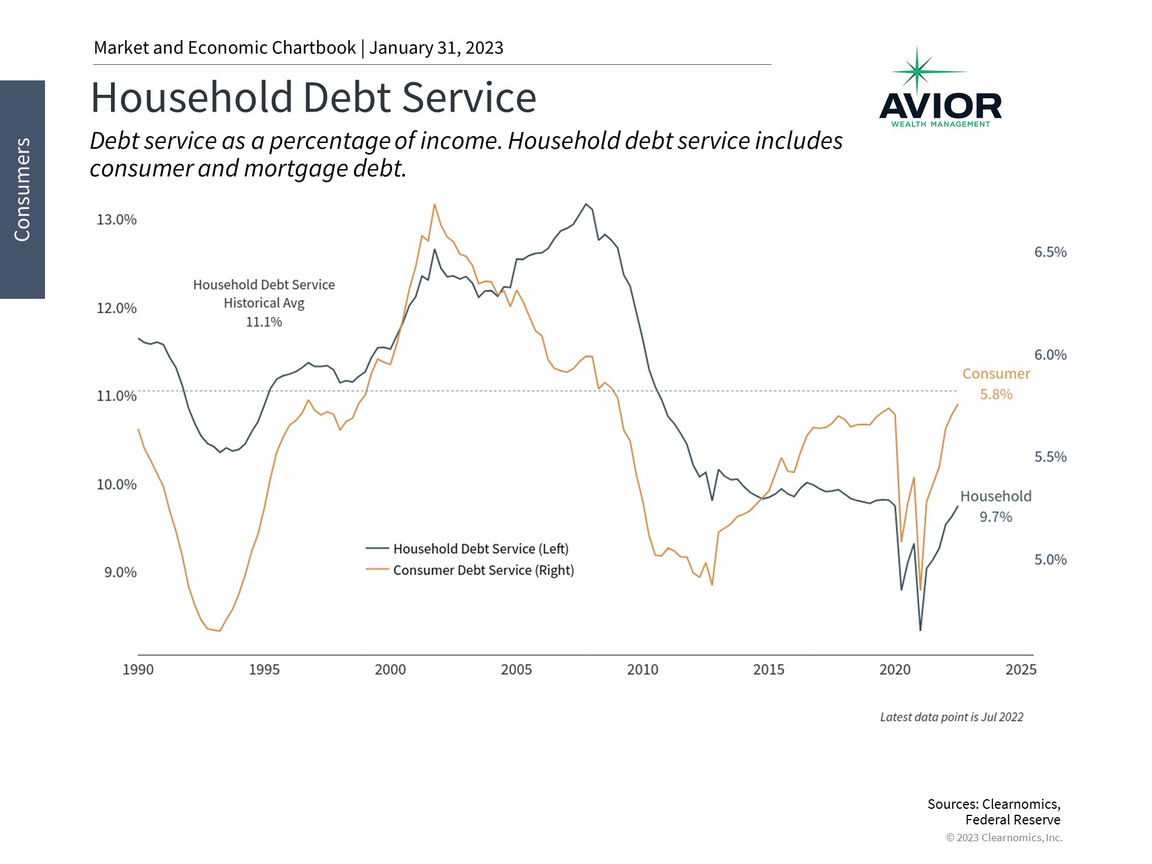

Household debt is growing

Third, consumer confidence has suffered due to high prices but is now recovering. Whether this continues will depend largely on the debt loads that many households are facing amid higher mortgage rates and signs that delinquencies may be rising in areas such as auto and personal loans. Still, debt levels are nowhere near levels that led to the 2008 financial crisis.

Ultimately, recessions and layoffs are a natural part of the economic cycle. These are times when workers, especially those with advanced training and highly specialized skills, are re-allocated to where they are valued the most. Specifically, areas like tech that may have overexpanded in recent years will continue to see workers change companies and even industries, eventually reaching a new equilibrium. Just as it has across history, this sets the stage for future growth.

The bottom line? While layoffs are challenging for individuals, investors should maintain balance as the effects of overexpansion within sectors and higher interest rates across the economy play out. History shows that these periods often set the stage for future business cycles.

Disclosure: This report was obtained from Clearnomics, an unaffiliated third-party. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.avior.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments.

Avior Wealth Management, LLC, 14301 FNB Pkwy, Suite 110, Omaha, Nebraska 68154, United States, 402-218-4064

No Comments

Sorry, the comment form is closed at this time.