AVIOR INSIGHTS – Why Investors Are Feeling Déjà Vu Around the Fed and Inflation

For investors, it may feel like déjà vu all over again as inflation and the Fed dominate market headlines on a day-to-day basis. After all, the numerous market swings last year were driven by ever-changing expectations around the Fed – both when investors believed the Fed was doing too little, and when they thought the Fed was tightening too much. With markets once again concerned about the direction of the Fed, what do long-term investors need to know about how the story is evolving?

Only three weeks ago at the Fed’s latest press conference, FOMC Chairman Jay Powell stated that “the disinflationary process has begun.” This is undeniably true across many parts of the economy as inflation has eased. However, recent data raise new questions around how quickly inflation is improving and whether the Fed will need to act more forcefully in the coming months. Not surprisingly, this has spooked markets.

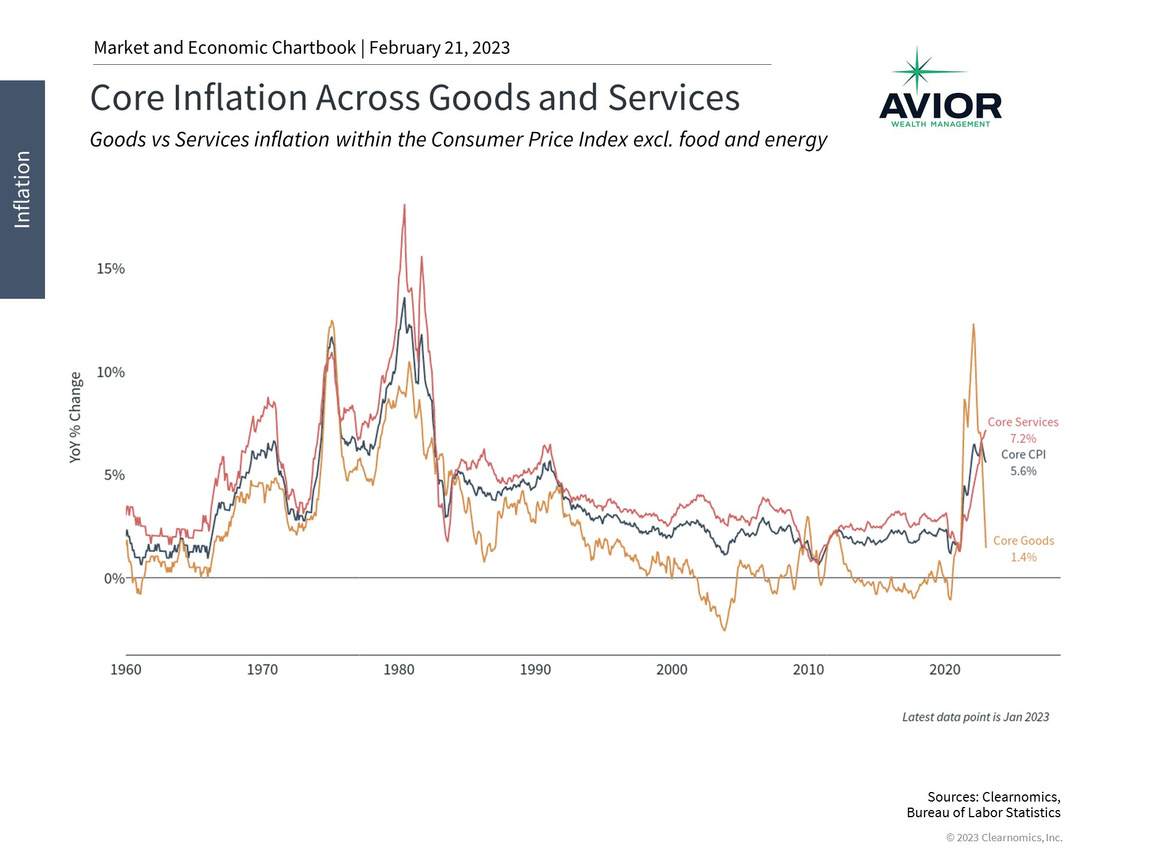

Goods inflation has improved but services are still a problem

The challenge facing markets and the Fed is simple: textbook economic theory says that inflation is the result of an overheating economy. Thus, in order to beat inflation, the Fed may need to slow the economy to a crawl or even cause a recession as it did in the early 1980s. While it’s unclear whether a recession will occur in 2023, most forecasts suggest that the economy will be flat this year, at best. This is the case despite a historically strong job market with unemployment of only 3.4%. Thus, the conundrum is whether the Fed will need to break the job market to beat inflation.

There are many ways economists slice and dice inflation data to best understand the underlying trends. One common way is to compare overall inflation, also known as “headline” inflation, to inflation without food and energy prices, also known as “core” inflation. This is not because food and energy are unimportant to consumers but because these prices tend to bounce around as commodity prices fluctuate, making it difficult to understand the trajectory of inflation. Recent data show that headline inflation has been decelerating – hence, Powell’s disinflationary comment – but core inflation remains stubbornly high.

However, another useful way to break down prices is to consider goods versus services within core inflation. Goods are physical, tangible items that consumers buy including new and used vehicles, apparel, home appliances, and more. Services are everything else – rent, transportation services, medical care, etc. Goods and services are both important to consumers but can be driven by different factors.

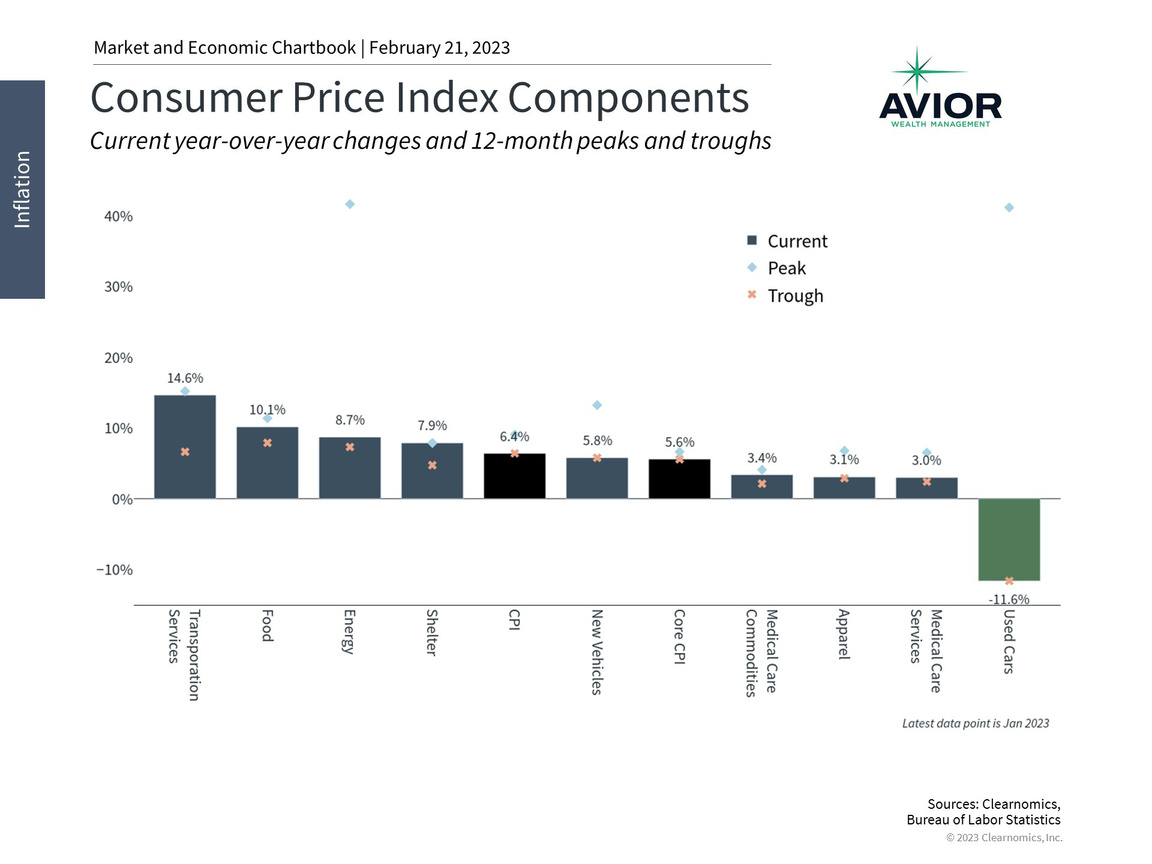

Many categories of consumer goods and services have improved

In many ways, this breakdown more closely aligns with what consumers have experienced over the past few years. Early in the pandemic, goods prices skyrocketed due to shortages of everything from toilet paper to computer chips. Today, these prices have improved with core goods inflation running at only 1.4% year-over-year. Used vehicles, for instance, have experienced a price decline of 11.6% over the past year, as shown in the accompanying chart.

The prices of core services, on the other hand, climbed 7.2% in January compared to the prior year. It’s for this reason that economists worry about the red hot labor market, including wages that are increasing 4.3% year-over-year for all workers and 5.1% for hourly workers. Higher wages that translate into more spending on services could create inflationary pressures. Retail sales, for instance, surged in January after slowing late last year.

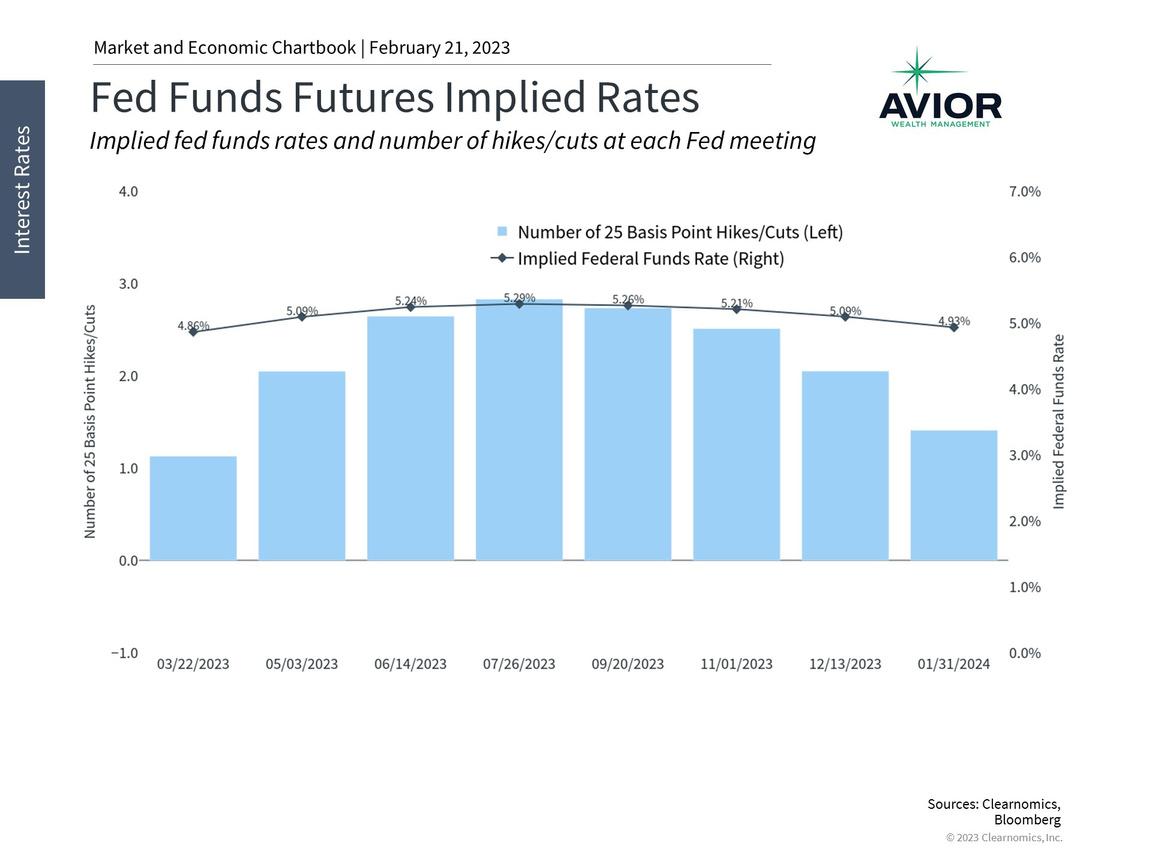

The Fed is now expected to raise rates higher this year

This takes us back to the conundrum mentioned above. While headline inflation is easing, core inflation is still far beyond the Fed’s target due to the prices of services. Standard economic theory suggests that this is driven largely by a strong labor market. Thus, markets are concerned that the Fed may have to do more. At the moment, market-based expectations are for the fed funds rate to rise to 5.25% or higher by mid-year.

For long-term investors, it’s important to maintain perspective in this market environment. After all, the stock market has fluctuated wildly over the past year based on Fed expectations, with swings in both directions as investors and economists evaluate the constant flow of data. Inflation has been difficult to predict accurately and both sides of the argument have been wrong at one time or another. Throughout all this, the S&P 500 has risen 14% since last October and the bond market has done better this year as interest rates have been somewhat more stable.

The bottom line? Headline inflation has improved since it peaked last June but core inflation, and services in particular, remain a challenge. The Fed will need to walk the line between fighting inflation and maintaining economic growth. Long-term investors should stay the course and not react to the inevitable market swings.

Disclosure: This report was obtained from Clearnomics, an unaffiliated third-party. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.avior.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments.

Avior Wealth Management, LLC, 14301 FNB Pkwy, Suite 110, Omaha, Nebraska 68154, United States, 402-218-4064

No Comments

Sorry, the comment form is closed at this time.