AVIOR INSIGHTS – What Slowing U.S. Manufacturing and Growth Mean for Investors

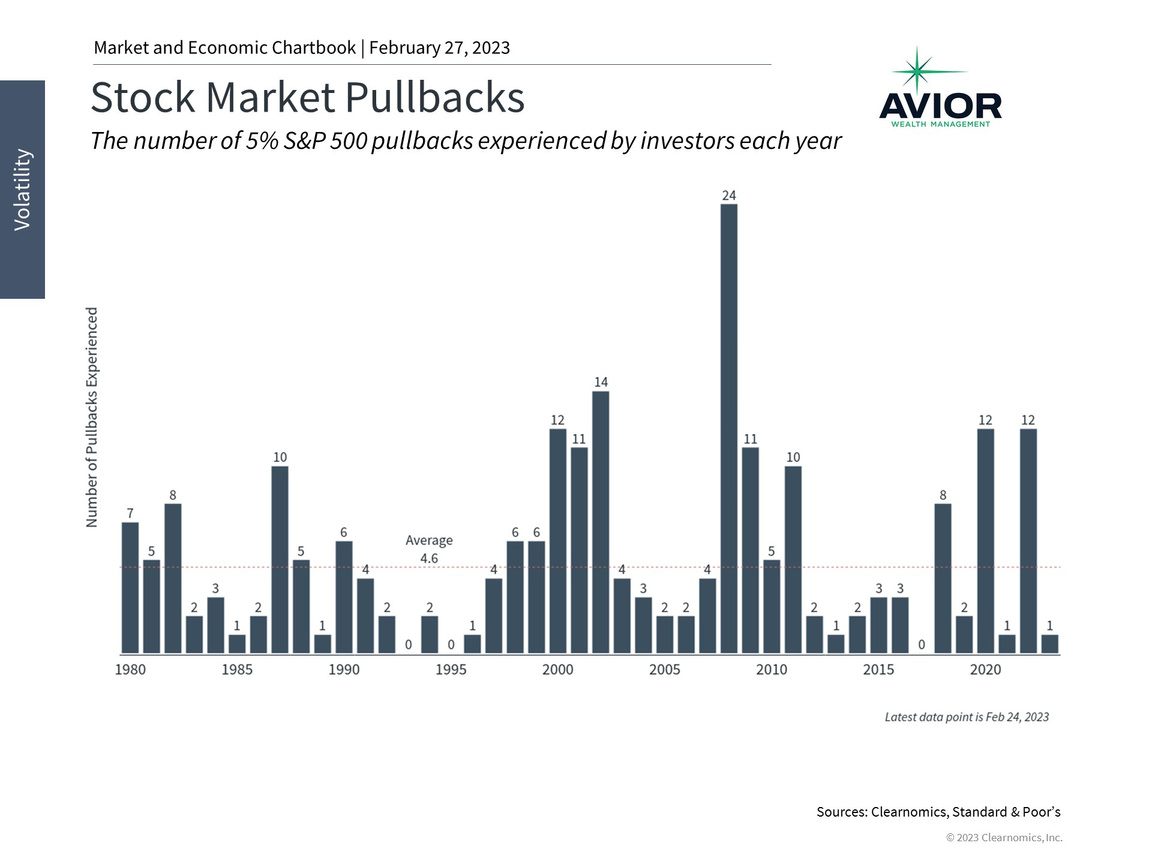

Stock market volatility has once again picked up as recent economic data have led markets to reverse course after a strong start to the year. While investors have grown accustomed to daily swings, it’s still important to remember that stock market fluctuations are normal, expected and unavoidable. After all, it’s the willingness and ability to withstand pullbacks in the short run that allows investors to be rewarded in the long run. During periods of uncertainty, understanding the underlying trends driving markets can help investors to maintain perspective.

Specifically, the S&P 500 declined 2.7% last week and is now up 3.4% year-to-date. There has been a divergence between the Dow which was strong last year but is now slightly in the red, and the Nasdaq which struggled last year due to its tech concentration, but is now up 8.9% on the year. This is further evidence that markets can turn around when it’s least expected, and investing based only on recent patterns doesn’t always work.

The economy has decelerated in recent months

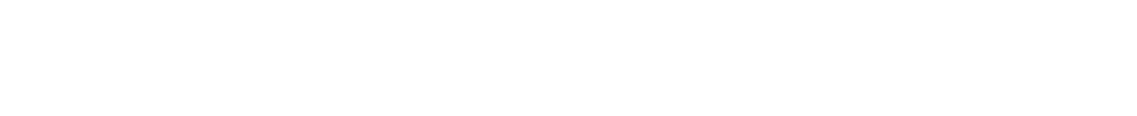

What dynamics are driving markets beneath the surface? First, there is no doubt that the economy has slowed in recent months. The accompanying chart shows that an index of leading economic indicators has contracted on a year-over-year basis. U.S. GDP data for Q4 was also revised down slightly to 2.7%, meaning that growth was still positive at the end of last year, but was weaker than originally believed. This was due to slower consumer spending and exports.

Meanwhile, inflation figures for January were unexpectedly hot with PCE inflation – the measure that the Fed favors – still far above the Fed’s 2% target, stoking concerns that the central bank may need to raise rates more aggressively. They are now expected to push the fed funds rate to nearly 5.5% later this year.

Second, and perhaps more importantly, is the divergence between goods and services. Goods are tangible items that consumers and businesses need such as cars, food, gasoline, clothing, home appliances, and more. Services are everything else, such as eating at restaurants, rent, education, medical care, etc. One defining characteristic of the past few years is that the demand for goods skyrocketed during and after pandemic lockdowns, while services languished as consumers stayed home. This has reversed as life has returned to normal across the country, shifting spending back to services.

Manufacturing activity has slowed but services are still growing

Much of this is by design as the Fed attempts to slow the economy. A textbook explanation is that raising interest rates makes it more attractive for consumers to save instead of spend, slows interest-rate sensitive parts of the economy like housing, and reduces consumption and business investment activity. Combined with the fact that households only need so many toasters and exercise bikes, it’s not surprising that goods have led the slowdown across all consumer spending.

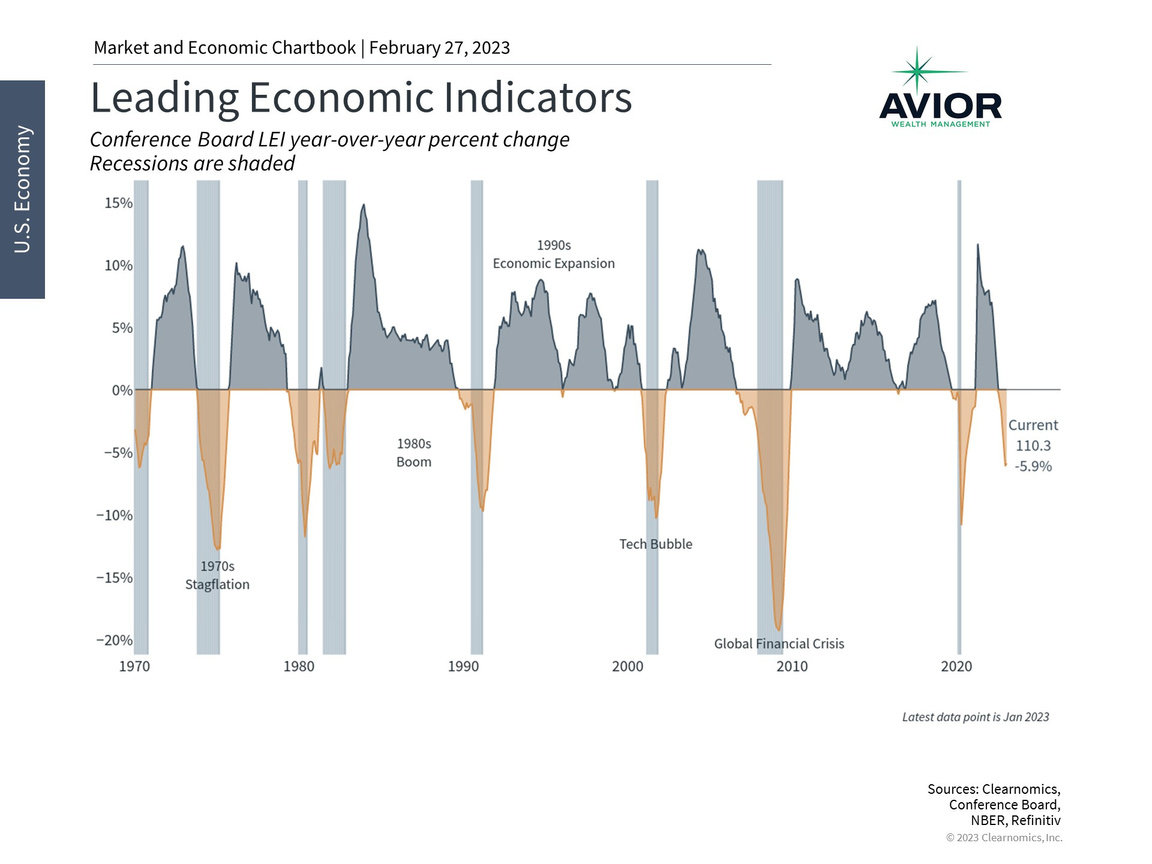

This, in turn, has resulted in a slowdown in manufacturing which can be seen across a variety of data. The accompanying chart shows that the manufacturing PMI – a measure of economic activity – has contracted. Services PMIs, on the other hand, are still expanding after a brief dip. This can also be seen in other data such as industrial production which has decelerated to a year-over-year growth rate of less than 1%. Capacity utilization, a measure of how much manufacturing capacity is being used across the country, has slipped to 78.3% in total and 77.7% for manufacturing. Finally, durable goods orders plummeted in January by -4.5%, after growing 5.1% the previous month.

This is occurring at a time when “reshoring” manufacturing back to the U.S. is part of the economic and political debate. One lesson of the past few years is that while global supply chains can be a boon when things are running smoothly, they can also be fragile when there are unforeseen economic shocks, whether related to the pandemic or Russia’s invasion of Ukraine. Securing these supply chains through policies such as the CHIPS Act and individual business decisions will likely be a priority in both the public and private sectors over the next several years.

Despite recent swings, markets have been calmer in 2023

So, what does this all mean? It’s clear that the economy has slowed and that the differences between goods and services are driving both growth and inflation. However, not only is this widely expected with GDP anticipated to be flat in 2023, but there are always swings and uncertainty in the data. The fall in durable goods, for instance, is largely due to a decline in aircraft and parts orders after it surged the month before.

Inflation can vary significantly from month-to-month too, especially as rent and housing prices stabilize due to rising rates. Fed expectations have shifted higher in recent weeks, but they have also fluctuated wildly over the past year. While data is important, focusing too much on any individual datapoint can be problematic.

The bottom line? Investors should remember that markets have regained significant ground since last summer. Diversified portfolios are mostly in the black this year and the S&P 500 has only experienced one 5% pullback in 2023. Staying invested can be difficult amid all of the negative market headlines but it’s ultimately what allows investors to achieve their long-term goals.

Disclosure: This report was obtained from Clearnomics, an unaffiliated third-party. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.avior.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments.

Avior Wealth Management, LLC, 14301 FNB Pkwy, Suite 110, Omaha, Nebraska 68154, United States, 402-218-4064

No Comments

Sorry, the comment form is closed at this time.